Improving Workforce Outcomes Through Financial Coaching

Lessons Learned Through Application

LISC's Financial Opportunity Center® Model

Local Initiatives Support Corporation (LISC) Chicago and our partner organizations have been operating the Financial Opportunity Center® (FOC) network since 2005. The FOC model is an integrated service delivery strategy that equips low-income people with tools, support and know-how to boost earnings, build credit, reduce expenses and make sound financial decisions.

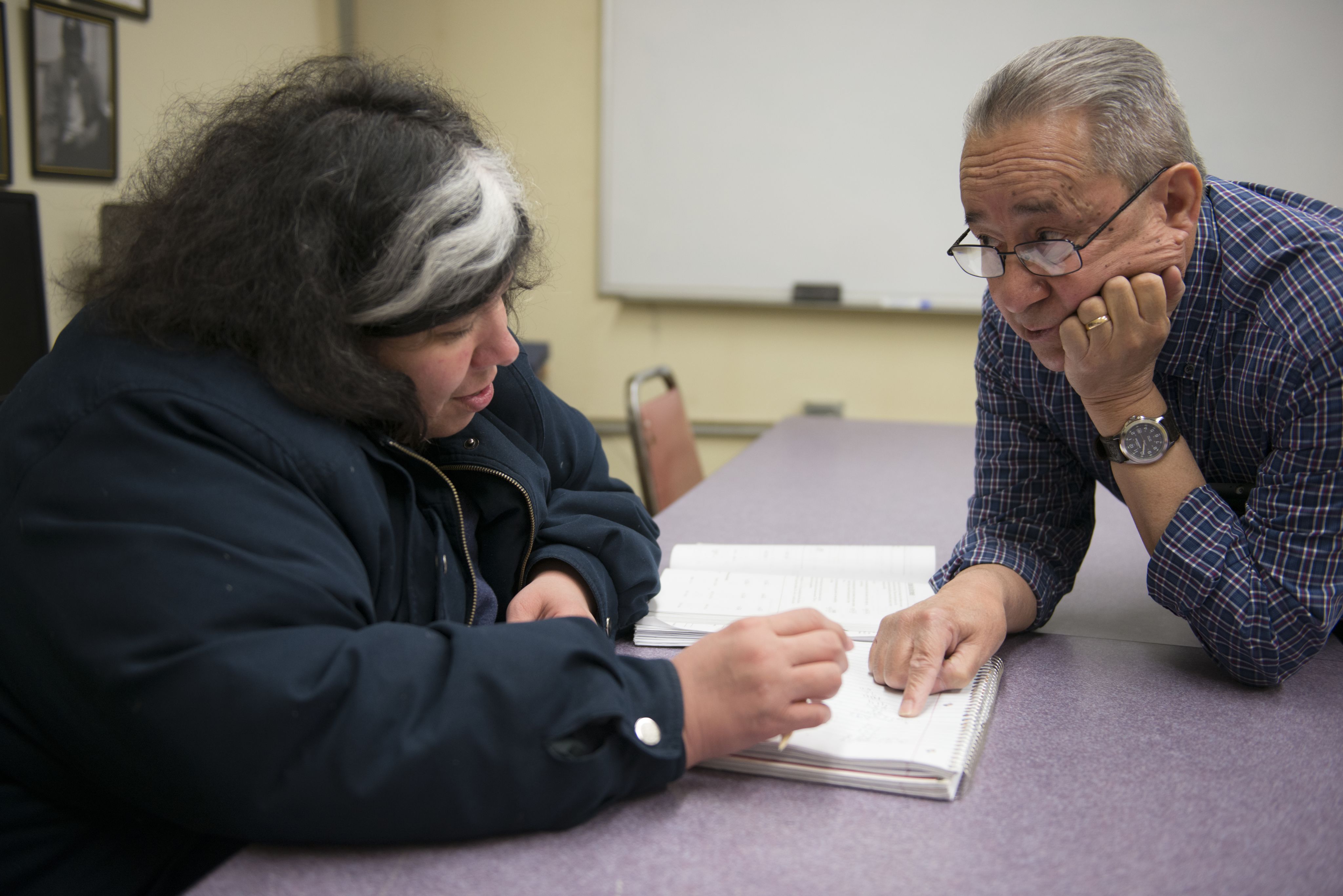

Each FOC client has access to a network of coaches that help them with job placement, retention and advancement; access to public and private benefits to supplement earnings; and managing a budget. FOCs coach families as they strive to become more financially stable through employment and/or increased wages, improved financial condition and improved access to public benefits.

When financial coaching is integrated into workforce services, families have more opportunity to increase their net worth through action planning, credit building, debt reduction and asset building. By incorporating financial coaching into their services, workforce organizations deepen the support they provide to their clients, equipping them with the financial capability strategies necessary for short- and long-term success.

Since 2005, LISC has partnered with 22 organizations supporting more than 12,600 people with job placement and helping over 10,500 people improve their net worth, FICO credit score and/or monthly net income. Guided by this experience, LISC Chicago launched the FOC Model Implementation Academy in 2019 to train more workforce development organizations how to integrate one-on-one financial coaching into their existing service delivery model.

What follows is a summary of the insights LISC Chicago has gained from years of working with organizations to adopt and implement the FOC model.

The case studies highlight the experience of five Chicago-based organizations that participated in the Academy and are continuing to actively implement the model within their workforce services.

Financial Coaching is one way to tackle the racial wealth gap

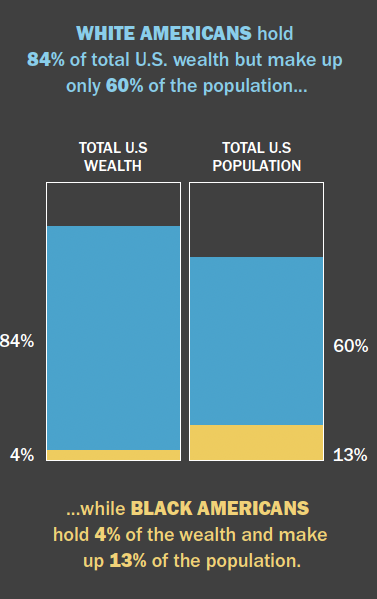

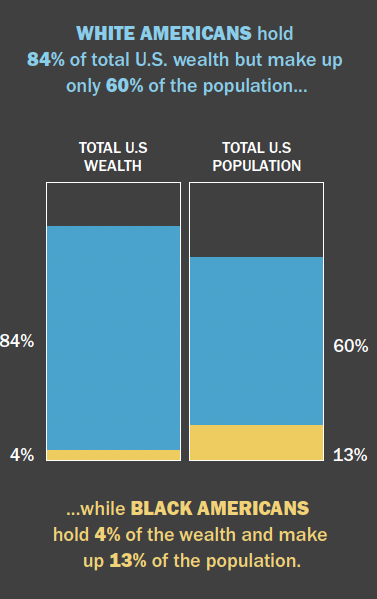

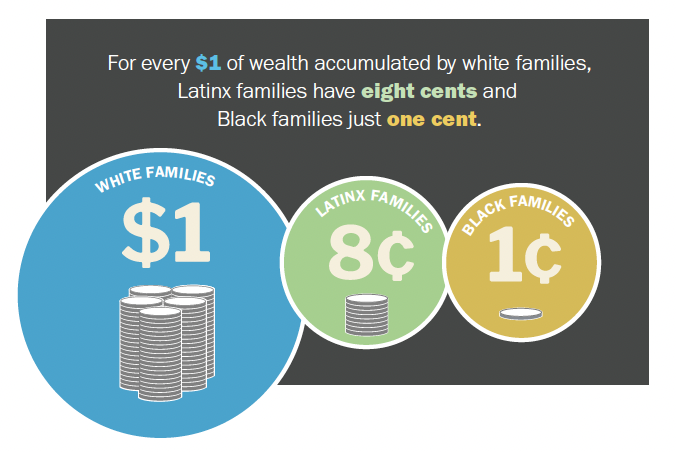

The racial wealth gap in America between Black, Latinx, and White individuals is both shocking and well-documented. White Americans hold 84 percent of total U.S. wealth but make up only 60 percent of the population—while Black Americans hold 4 percent of the wealth and make up 13 percent of the population. In Chicago, one of the most segregated cities in the country, the wealth gap is even more stark.

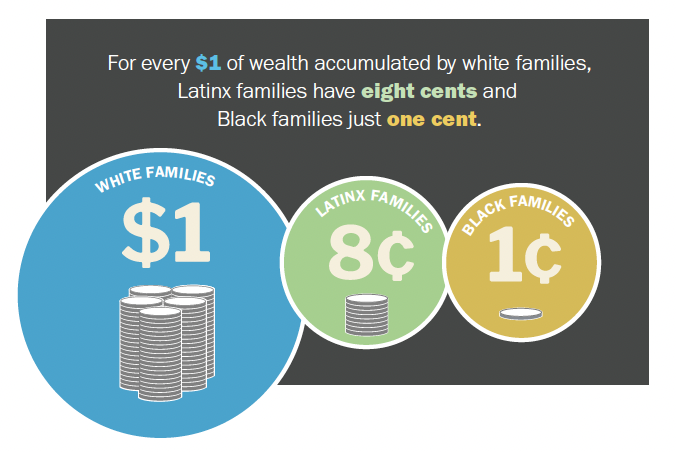

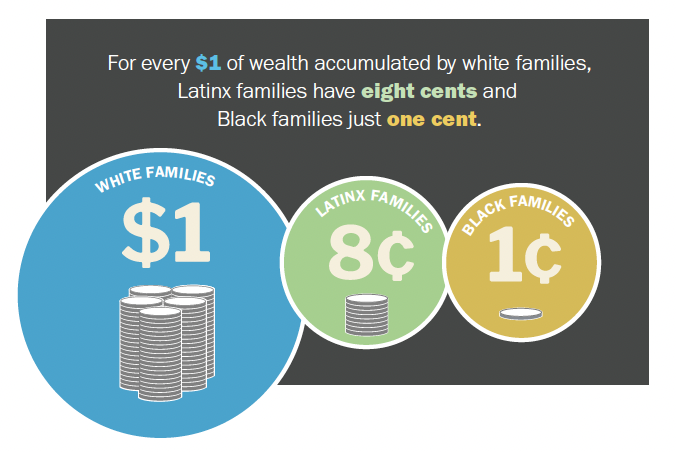

For every $1 of wealth accumulated by white families, Latinx families have eight cents and Black families just one cent.

Established through the emancipation of millions of slaves who had no assets, the racial wealth gap has been perpetuated by racist policies limiting Blacks’ access to land, credit, and homeownership, and has become entrenched through the unequal distribution of capital gains. The enduring legacy of these policies means that Black and Latinx individuals in the U.S., on average, have lower earnings, less access to banking services and higher loan denial rates than their White counterparts leaving them less able to invest in economic mobility; support family, community, and future generations; care for their health and well-being; or feel a sense of control and dignity in life.

LISC Financial Opportunity Center® Model

FOCs Provide Integrated Services

For individuals and families who earn low- and moderate-incomes, finding employment is just one part of the equation to achieving economic stability and financial capability. The LISC FOC Model is an integrated, long-term approach, where participants are supported by coaches invested in their lasting financial success.

There are three main components to the LISC FOC Model: employment services, financial coaching, and connection to public benefits and income supports. Woven throughout the model are digital access, inclusion, and training activities.

FOCs equip clients with the tools, motivation and know-how to make sound financial decisions that increase earnings, build credit, reduce expenses and boost assets

Employment Services

Employment services assists individuals in finding and maintaining living wage employment. These services can include employment and career counseling, job readiness training and placement, access to education and training and job retention and advancement coaching.

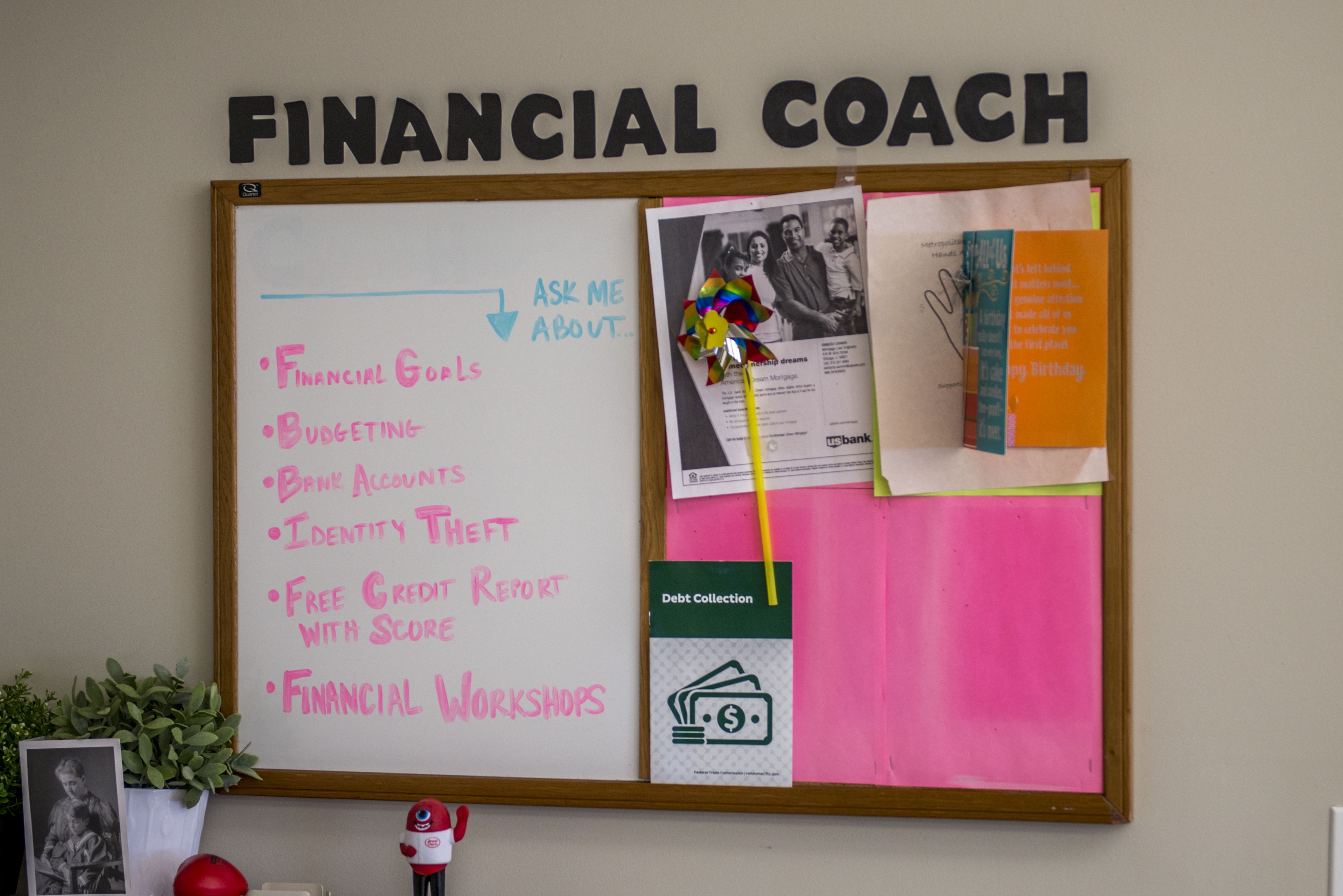

Financial Coaching

Coaching provides one-on-one support with short- and long-term action planning. Valuable strategies and options are shared to reduce debt, build credit, and increase financial capability skills. Participants can engage with safe financial products that lead to asset building opportunities.

Income Supports

Connection to public benefits and community Resources allows low- and moderate-income participants access to critical safety-net services on their journey towards financial stability. These services can include the Supplemental Nutrition Assistance Program (SNAP), childcare subsidies, housing and energy assistance, food pantries and Earned Income Tax Credit.

Digital skills training

Digital opportunity and inclusion activities help participants better navigate the digital world through access to discounted internet services, troubleshooting of equipment problems, use of tele-health services, access to government services, enrollment in computer skills training programs, support with job applications, and more.

FOC Model Implementation Academy

While Chicago’s FOC network currently has the capacity to serve about 3,500 people a year, in a city of over 2.7 million people, having a larger reach is critical for greater impact.

Over the years, many organizations have expressed interest in implementing the FOC Model but have cited financial resources, staff capacity and the lack of leadership buy-in as major barriers. In 2019, to address these concerns, LISC Chicago launched the Financial Opportunity Center® Model Implementation Academy to help organizations learn how to integrate the model’s best practices into their own service delivery.

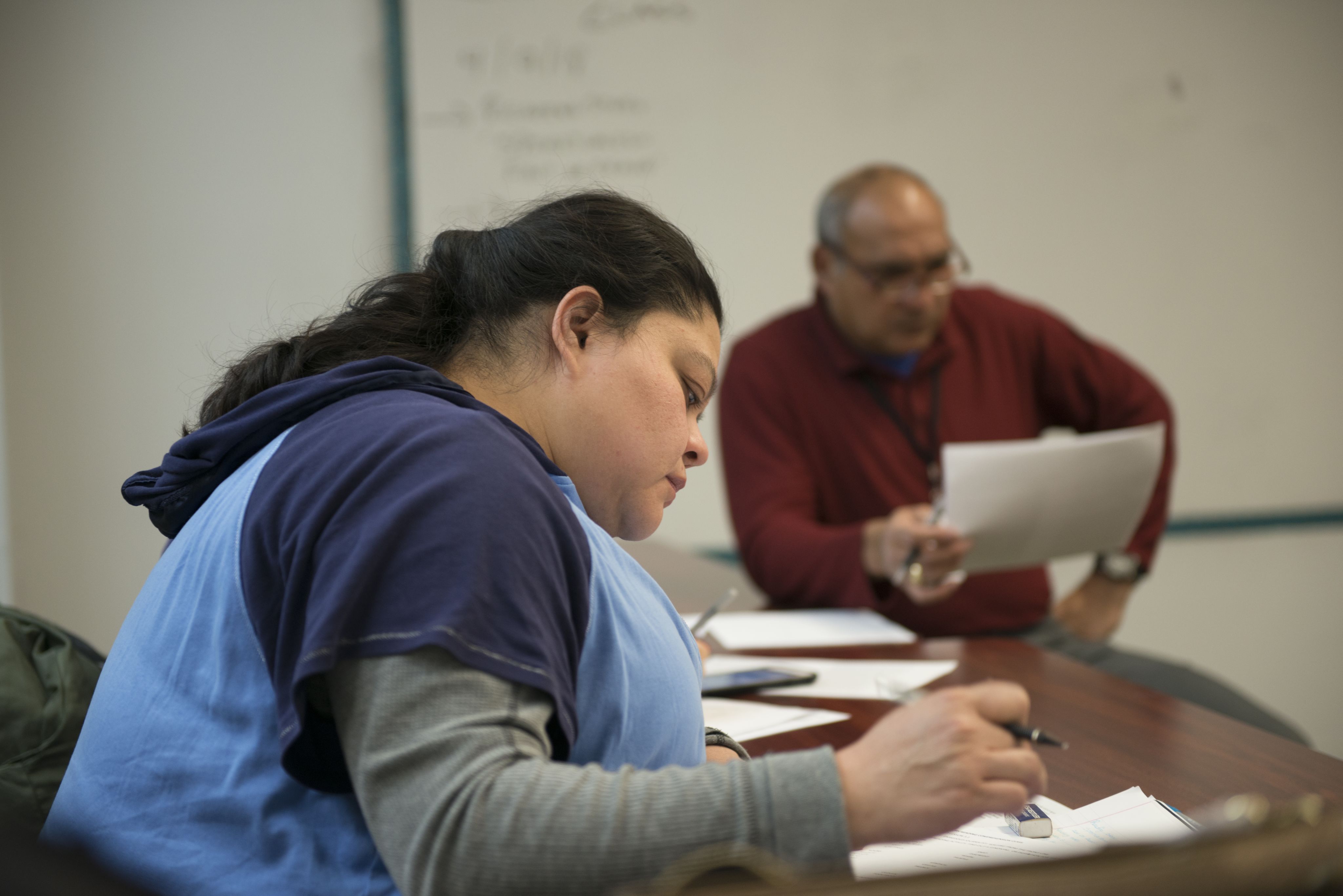

Through a rigorous, cohort-based learning opportunity, workforce development organizations had the opportunity to engage in peer learning sessions about the FOC model, receive technical assistance from LISC staff to support integration, and pursue related training through LISC’s professional development offerings.

Through bi-monthly sessions, frontline staff from participating organizations met to discuss both what successful elements of an FOC are as well as how they could be implemented within their own programs. Participants were required to attend each session, complete extension activities between meetings, and participate in regular check-in meetings with LISC staff. Organizations were selected based on their location (the Academy targeted entities on Chicago’s South and West sides given their higher rates of unemployment and poverty) and their interest and capacity to implement the FOC model. Since its inception, LISC has worked with 9 organizations through its Academy model.

The following insights are from five organizations that completed the Academy and are currently incorporating elements of the FOC model to strengthen their workforce service delivery.

Breakthrough Urban Ministries

1. Provided services to 164 clients, placing 67 individuals in jobs and another 37 individuals in unsubsidized employment earning an average wage of $14/hr.

2. Staff report higher and more meaningful engagement with the community.

3. Two new positions – a financial coach and an income support coach–have been added by executive leadership.

Chicago Commons

1. Provided employment coaching to 117 individuals and financial coaching to 219 individuals, of which 80% reported reducing their debt.

2. Of the parents who participated in their programming, 90% indicated that the supports they received were critical to their success.

3. New, internal monthly action meetings allow staff to track participant outcomes throughout the process, remain focused on their work, and identify resource vulnerabilities to quickly build capacity.

Hope Center Foundation

1. Acquired additional funding that allows for the implementation of more long term sustainable programming.

2. This funding has been used by executive leadership to hire more coaching staff, train existing staff and increase their capacity to serve their community.

Northwest Center

1. Northwest Center saw a 177% increase in the number of individuals receiving coaching services from 2018 to 2020; they have also graduated 171 women from the Adelante program.

2. Some clients have become volunteer coaches and have even joined the staff of the organization.

3. Staff have experienced improved wellness through the implementation of weekly executive coaching and paid time off to mitigate stress; coaches report feeling more supported by their direct supervisors.

Phalanx Family Services

1. Phalanx is currently hiring a financial coach and continues to work closely with LISC as they strengthen their implementation plan.

2. Soon the organization will have enough coaches to fully implement one-on-one financial coaching completely in-house.

Through the Financial Opportunity Centers® model LISC Chicago and our partners are contributing to closing the racial wealth gap by providing employment and career counseling, one-on-one financial coaching and education and low-cost financial products that help build credit, savings and assets. When workforce organizations integrate these activities into their core services, they and their job seekers see improved outcomes in the form of longer-term employment, decreased debt, and increased credit scores.

Other workforce development agencies across the country can use these insights to support the planning, development and implementation of financial coaching. Several concrete steps were outlined to help interested organizations get started, including:

1. Conducting research on and site visits to existing FOC organizations

2. Hosting a service integration retreat to ensure all staff are on the same page

3. Restructuring onboarding processes and developing an internal communication plan and client flow to ensure all staff are trained in the integrated service model

4. Planning for sustainability by diversifying revenue sources

5. Planning for ongoing staff training to ensure emerging best practices in financial coaching are adopted.

While not a “one size fits all” approach, these steps offer workforce development agencies an opportunity to deepen both the client and staff experience while contributing to closing the racial wealth gap.

Learn more about how Financial Opportunity Centers® have the potential to close the racial wealth gap: